Up front disclosure: Altimeter believes in fostering trust with the market, and we disclose who our clients are, providing they agree. Some of the vendors listed below are clients.

Summary: Nascent Market Appears Similar, Confusing Buyers

Overall, the Social Media Management System (SMMS) space lacks market differentiation when it comes to market positioning, which is often reflective of feature set. Furthermore, many of these low-barrier technologies are being developed rapidly, and a feature war has set in. As a result, buyers are often confused, resulting in longer evaluation and consideration phase, and heterogenous mix of vendors in an RFP processes. Furthermore, the lack of market differentiation hurts vendors, who may have greater sales costs, and longer sales cycles during a convoluted RFP process. This is normal in an emerging market, and expect the maturity of the nascent SMMS space to follow similar patterns to the maturing Community Platform space.

Buyers often indicate they are very confused by the vendors in the Social Media Management Systems space, let’s probe to find out why. One initial observation is the explosion of over 25 vendors in a short period of time, the following analysis is based of the following vendors: Argyle Social, Awareness Networks, Buddy Media, Constant Contact, Context Optional, Conversocial, CoTweet, Engage Sciences, Expion, Hootsuite, MediaFunnel, Moderation Marketplace, Mutual Mind, Objective Marketer, Postling, Seesmic, Shoutlet, SocialVolt, SpredFast, Sprinklr, StrongMail, Syncapse, Vitrue, and Wildfire.

Why Positioning Is Important

Messaging is often the first thing prospects see and as a result, where I will focus today. Why? This is the first thing that buyers see (positioning) before even evaluating the feature set. Furthermore, I’ve done a similar exercise before with the community platform space a few years ago, a space I draw clear parallels as the SMMS space follows suit. Clearly this isn’t a comparison of features or offerings (we may do this in our next report), but a sampling of what prospects see as they first glance at this emerging and growing market.

Method: Visiting Each Vendor’s Website, Like a Buyer

Here’s how I conducted this process: First, I put myself in the place of the buyer and imagined their task of sorting through this new space and short listing it. Then, I went to the website homepage and sought to find the dominant messaging that would resonate from the vendor: tag lines, descriptors or even the HTML title at top of browser. If they didn’t have this, I had to go to About page or even Product page in some examples. To show my work, I’ve also provided a Google sheet where you can see my tallies across the 25 vendors.

List of Positioning Statements from 25 SMMS Vendors

Here’s what I found (vendor names removed) can you identify which of the messaging applies to which vendor? (answers in link below).

- Social Media Marketing

- Offers you the most comprehensive suite of features designed to take your social media campaigns to the next level.

- Social Media Management System and Content Aggregator for publisher and Developers

- Social Media Management for Business

- How Business Gets Social

- SocialVolt Social media management software for Businesses and Agencies

- Social CRM Enterprise Software for Social Media Marketing

- Social Marketing Software

- Every Brand needs a Buddy

- “Vendor” is a social media management system (SMMS) that helps businesses get closer to customers to create online engagement where it matters most.

- Build and monetize your Facebook and Twitter following through social campaigns

- We make brands social

- Interactive promotions for brand marketing by “Vendor”

- Social media marketing for small business

- Enterprise Social Media Management

- The Social Marketing Suite is the leading fully integrated, software as a service platform for managing social media presences

- Social Media Management System

- Is a social media publishing solution that enables marketers to monetize their investment in the channel through the proper application of proven direct marketing principles.

- Your Social Media Management & Technology Partner

- Engage Everybody. Everywhere. Easily. Create on brand identity, managed from one place, living simultaneously, on many sites and devices

- Power your brand on Facebook + 100 other social sites Create, manage, and measure all of your social media marketing communication with one powerful but intuitive tool.

- Social media applications for web, mobile, and desktop

- Provides small businesses with the tools, alerts, and insights to get the most out of social media.

- Social Media Dashboard for the Social Enterprise

- Social Media Dashboard

See Answer Sheet with Vendor Names

To see the name of the vendor and the associated messaging above, see the answer sheet.

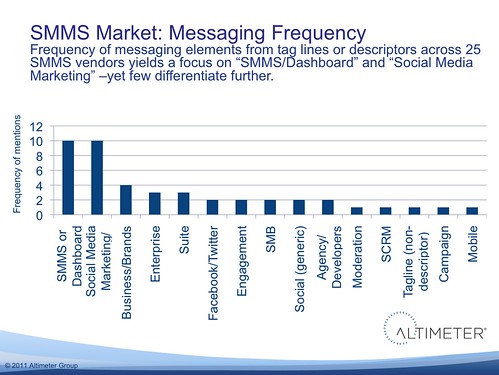

Above Graphic: Most vendors have centralized their messaging around “SMMS’ (10/25) or “Social Marketing” (10/25) yet few have evolved messaging to either specific markets, verticals. There were stronger mentions in differentiation around market purpose: with more focus on Business (4/25), Enterprise (3/25), and even SMB (2/25). However, there is differentiation in terms of channel with a peppering of mentions around Mobile, SCRM, Facebook/Twitter. Overall, when removing company name from taglines, most taglines (aside from Buddy Media) were indistinguishable from the next.

Findings

- Market Positioning Centered on variations of “SMMS” and “Social Marketing”. High adopt of category term, Most vendors (10/25 vendors), adopted the term Social Media Management System or Dashboard in their primary messaging. Secondly followed by high adoption of permutations on the phrase “Social media Marketing (10/25 vendors). While I certainly encourage the adoption of the term SMMS (which I use as the category name since March 2010), the term Social Media Marketing isn’t fully representative of the overall use case, which can include support and customer service. Furthermore, four of those those that did use the terms SMMS, didn’t have follow up descriptors helping to differentiate.

- Some Vendors Lacked Appropriate Descriptors. During my visit to all 25 vendors pages, not all of them had consistent taglines, descriptors, or positioning. In some cases, I had to go to the product pages to find out exactly what they do, which can be a turn off for buyers. I’m sure that many vendors will suggest that I got the wrong messaging they were trying to convey, but I treated each experience the same, acting like a buyer, if I didn’t get your intended message, that in itself should be evaluated, as likely your prospects may be experiencing the same.

- Despite a Market of 25 Vendors, Few stood out from Pack. Take a look at that list above, these positioning statements are pretty much the same, there’s no doubt why buyers are so confused. This space is confusing, they all look alike, except for Buddy Media. yet despite being the sole stand out, their tag line isn’t descriptive of what they offer, nor a value statement. Traditionally, marketing tag lines require years of investment and market awareness before shifting to a non value-statement tag line. While cute, I don’t think it’s as helpful compared to their title statement “Facebook Marketing | Social Media Marketing | Power Tools for Facebook” which is descriptive, if Buddy could merge both catch line and descriptor, they could be a contender to stand apart.

What It Means:

- Lack of Market Positioning is a sign of lack of Product Differentiation. While we’ve not made a direct causation between similar features and positioning statements, we know from vendor briefings and client meetings that the offerings are often the same. As a result, buyers rely on WOM between each other, as well as viability and vision crafted by each of these vendors.

- Immature Market Lacks Educated Buyers –and Vendors Not Sure Future Vision. The market confusion isn’t just stemming from the vendors, buyers are still getting educated on this space as we know that adoption is growing –slowly.

- Rapidly Changing Feature Set Will Continue Confusion. This space is early, it’s just over a year old from category naming and it continues to evolve. Expect the vendors to ever battle over features, matching what other competitors beat them in bids. Like the community platform space, we saw similar confusion and then market clarity as winners emerge.

Continuing Altimeter Coverage on the SMMS Space

We’re currently doing data cuts on a survey to 140 enterprise buyers on the SMMS space, and about a similar amount for the SMB space, and have data on: number of accounts companies have to manage, number of business accounts, top feature desires, feature satisifaction, adoption rates. Altimeter clients have access through advisory opportunities. Also Brian Solis is helping with vendor selection for a global national brand, as do I short list for buyers. Altimeter Group will be producing a report on the SMMS space, follow me on Twitter, and Andrew Jones to learn more.

Related Resources

- Again, see the Master List of the Social Media Management System Space

- See how I conducted a similar exercise for the Community Platform space a few years ago

- Read the State and Future of the SMMS Space

- Report: Spending and Adoption rates on Social Business

- Report: About the buyer, the Corporate Social Strategist

- Community Manager Appreciation Day (each Jan)

Thanks Jeremiah – we agree that this is a confusing space right now in terms of positioning, and we will shortly be releasing new position statements to greater clarify where we are. We are firmly seeing a number of market segments appear in the market, in particular between ‘content management’ application systems, that make it easy to manage the content in social apps (a core focus of Buddy Media, Involver etc); social CRM systems, that are B2B focused and pull social data into a CRM workflow; and ‘management’ systems that focus on the communication management through social channels (which we can fall into, as well as HootSuite, CoTweet etc). Within the management category, there are tools which focus more on the marketing side in terms of publishing and analytics, and others (like us at Conversocial) that focus more on enabling customer support at scale through social channels like Facebook pages and Twitter accounts.Â

We’ll let you know when our new positioning is live on the site!

I look forward to seeing the new positioning at Conversocial and taking a closer look into the product Joshua, thanks.

As a potential buyer that has been through a investigation process, I’d agree wholeheartedly that this market is not accessible to buyers. Key issues I found were:

– no differentiation between types of tools/feature lists – eg publishing (content management) and listening (search) and interaction (conversation management) tools. Â

– no statement of which SM channels the tool covers/manages eg. is it Twitter only? (commonly, yes).Â

– data reliability/noise varies wildly depending on cost

There are lots of people who have tried to grasp this differentiation and write about it on blogs etc, but common language doesn’t seem to exist. Any work that helps us all get to the point where we can shop off of a menu of features + capabilities and compare is helpful! SMMScompare.com anyone?

Dear Jerimiah,Â

Thanks you for the great post! (once again).Â

However, I do not think the social promotions vendors like Wildfire, Strutta, Buddy Media are playing in the same space as the pure SMMS players. Although, I see your intention behind this post is focused more on how they are all similar in terms of their marketing efforts. I have no objection to this finding, and I did encounter the same when I was doing a research as a part of my MBA earlier this year.Â

Just to make your comparison more robust, I am uploading a few slides from my MBA consulting work to show the promotions space (online and offline) and also a smaller comparison of SMMS players.Â

You can see it here :Â

SMMS Comparision -Â http://leelayz.tumblr.com/post/7492377889/post-smmscomparision

Interactive Promotions Comparison -Â http://leelayz.tumblr.com/post/7492753358/interactive-promotions-landscape

thanksÂ

Suva

SuvaÂ

Excellent analysis, I cruised through your analysis, good thinking. Â

Thanks Liz. Â The team from OneForty is doing some of the vendor comparisons. Â Have you seen their website?

Thank you for your kind words, Jeremiah!

I did spend horrible amounts of time doing this. All data was gathered from primary research(interviews) & secondary research(reports/websites). Â

Thank you for your kind words, Jeremiah!

I did spend horrible amounts of time doing this. All data was gathered from primary research(interviews) & secondary research(reports/websites). Â

Thank you for your kind words, Jeremiah!

I did spend horrible amounts of time doing this. All data was gathered from primary research(interviews) & secondary research(reports/websites). Â

Thanks for the mention Jeremiah – we agree that the space is incredibly confusing, and as another commenter has mentioned, even this subset is not necessarily apples-to-apples. Some of these came to the space via Facebook specialization, others by from radically different origins. It shows.Â

To make matters more confusing, vendors from other social media verticals are overlapping into the SMMS space by adding engagement features. We truly applaud you for trying to get your arms around the space!

We also find that most companies still augment a basic SMMS by combining many different types of specialty tools together even when they’re already using a purported “one size fits all.” This makes a lot of sense if you consider that you would never use a swiss army knife screwdriver to assemble a large piece of Ikea furniture.

Our approach at oneforty has been to support the buyer via a blog and a large business community that is reviewing, rating, comparing and putting these tools into toolkit “batches.” Â http://oneforty.com/i/toolkits. Want to see how a tool fits into the mix? Take a look at the toolkits it is in, and in particular, what other tools are also being used in that toolkit at the same time.

Following the user community’s lead, we now offer a social workflow/project management/collaboration tool called SocialBase. http://oneforty.com/solutions/socialbase SocialBase customers combine their preferred mix of tools and tasks, and then delegate these across their team (or for their individual workflow program using the Solo version). This enables the Social Champion/s (think: architects) internal or external to the organization to coordinate the efforts of teams with widely varying levels of experience at social (think: carpenters, people with hammers, people who can recognize a nail..).

To make matters even easier for the buyer, we have an exciting new announcement coming later on this week. More on that soon.

Warmly,

Laura

Thanks for the mention Jeremiah – we agree that the space is incredibly confusing, and as another commenter has mentioned, even this subset is not necessarily apples-to-apples. Some of these came to the space via Facebook specialization, others by from radically different origins. It shows.Â

To make matters more confusing, vendors from other social media verticals are overlapping into the SMMS space by adding engagement features. We truly applaud you for trying to get your arms around the space!

We also find that most companies still augment a basic SMMS by combining many different types of specialty tools together even when they’re already using a purported “one size fits all.” This makes a lot of sense if you consider that you would never use a swiss army knife screwdriver to assemble a large piece of Ikea furniture.

Our approach at oneforty has been to support the buyer via a blog and a large business community that is reviewing, rating, comparing and putting these tools into toolkit “batches.” Â http://oneforty.com/i/toolkits. Want to see how a tool fits into the mix? Take a look at the toolkits it is in, and in particular, what other tools are also being used in that toolkit at the same time.

Following the user community’s lead, we now offer a social workflow/project management/collaboration tool called SocialBase. http://oneforty.com/solutions/socialbase SocialBase customers combine their preferred mix of tools and tasks, and then delegate these across their team (or for their individual workflow program using the Solo version). This enables the Social Champion/s (think: architects) internal or external to the organization to coordinate the efforts of teams with widely varying levels of experience at social (think: carpenters, people with hammers, people who can recognize a nail..).

To make matters even easier for the buyer, we have an exciting new announcement coming later on this week. More on that soon.

Warmly,

Laura

Hi Jeremiah,

Thanks for this analysis. The former editor in me

wants to take the best soundbite and use it everywhere: “they all look

alike, except for Buddy Media.” But even though both you and I have

probably been misquoted many times, that would not be responsible!

I’m looking forward to the full report. As I’ve mentioned to both you

and Andrew, this is a fast moving and hard space to track. Since you’re

focused on the marketing at this point, and not on product, I will say

Buddy Media was the first to market a truly global solution, and hence

the first to truly launch large scale, global programs with clients.

I won’t get into more product stuff here, since that’s not the focus.

Re: @Suva’s comment, Buddy Media is not a “social promotions” vendor. We

offer much more than just promotions. See: http://www.buddymedia.com/platform

Also, I’m posting here on the blog, not on Twitter, as you wish : )

Cheers,

Joe

Hi Jeremiah,

Thanks for this analysis. The former editor in me

wants to take the best soundbite and use it everywhere: “they all look

alike, except for Buddy Media.” But even though both you and I have

probably been misquoted many times, that would not be responsible!

I’m looking forward to the full report. As I’ve mentioned to both you

and Andrew, this is a fast moving and hard space to track. Since you’re

focused on the marketing at this point, and not on product, I will say

Buddy Media was the first to market a truly global solution, and hence

the first to truly launch large scale, global programs with clients.

I won’t get into more product stuff here, since that’s not the focus.

Re: @Suva’s comment, Buddy Media is not a “social promotions” vendor. We

offer much more than just promotions. See: http://www.buddymedia.com/platform

Also, I’m posting here on the blog, not on Twitter, as you wish : )

Cheers,

Joe

Thank you so much Jeremiah for mentioning oneforty. Liz, you may find these blog posts useful.

http://oneforty.com/blog/how-to-evaluate-and-compare-social-media-tools/

http://oneforty.com/blog/social-media-monitoring-tools/

Thank you so much Jeremiah for mentioning oneforty. Liz, you may find these blog posts useful.

http://oneforty.com/blog/how-to-evaluate-and-compare-social-media-tools/

http://oneforty.com/blog/social-media-monitoring-tools/

Thanks Joe for the comments.

Well it comes with caveats, as while your tagline stands outside the others as being memorable –it’s not clear on how that’s a value statement, so I think there’s work to be done.Â

Keep it up!Â

Thanks Joe for the comments.

Well it comes with caveats, as while your tagline stands outside the others as being memorable –it’s not clear on how that’s a value statement, so I think there’s work to be done.Â

Keep it up!Â

It’s an *investment,* keep up the research –and passion!

It’s an *investment,* keep up the research –and passion!

Ugh, I just realized I forgot to make the above graph visible. Â I just enabled it now. Â (10:16am), I published earlier this morning and forgot to make it live.

Ugh, I just realized I forgot to make the above graph visible. Â I just enabled it now. Â (10:16am), I published earlier this morning and forgot to make it live.

What I like best about this post and the underlying premise is that it looks at this space not from an analyst’s perspective, but from the customer perspective. And through that prism this space is even more of a hot mess. It’s not a knock on SMSS category per se. You could change the date of this blog to 2004 or 2000 or 1998 or 1995 and replace the vendor names with people in the SEO, SEM, email, browser, web development et al spaces, and have the exact same circumstance.Â

Jeremiah, you’re dead-on in the assessment that this is symptomatic of a nascent category. It will settle out eventually through failures and M&A and strategic and product shifts.Â

But as an advisor to many companies and agencies, I can say first-hand that the marketing materials of essentially all of the companies in this category give you nearly no information about what they actually do (the forced demo seems to be the preferred inbound marketing method). That approach is doing them no favors as an industry.

What I like best about this post and the underlying premise is that it looks at this space not from an analyst’s perspective, but from the customer perspective. And through that prism this space is even more of a hot mess. It’s not a knock on SMSS category per se. You could change the date of this blog to 2004 or 2000 or 1998 or 1995 and replace the vendor names with people in the SEO, SEM, email, browser, web development et al spaces, and have the exact same circumstance.Â

Jeremiah, you’re dead-on in the assessment that this is symptomatic of a nascent category. It will settle out eventually through failures and M&A and strategic and product shifts.Â

But as an advisor to many companies and agencies, I can say first-hand that the marketing materials of essentially all of the companies in this category give you nearly no information about what they actually do (the forced demo seems to be the preferred inbound marketing method). That approach is doing them no favors as an industry.

Nice summary. Are those tag lines though or positioning statements? Or, simply the sign of a yet-to-emerge-market. Point taken. Lots to do here.

Hi Jeremiah,

Thanks for the post, it is refreshing to read about the SMMS space from a customer’s perspective (as Jay noted above). As is common in emerging industries, positioning for many vendors appears to be confused and lacks a clear value statement. At Syncapse we are undergoing brand positioning research and will be releasing updated materials that highlight our core value offering: expert strategic services, combined with software, designed to global enterprise marketers. I will let you know once our new positioning is finalized – we would welcome your feedback and advice.

Thank you,

Meg Sinclair

Hi Jeremiah,

Thanks for the post, it is refreshing to read about the SMMS space from a customer’s perspective (as Jay noted above). As is common in emerging industries, positioning for many vendors appears to be confused and lacks a clear value statement. At Syncapse we are undergoing brand positioning research and will be releasing updated materials that highlight our core value offering: expert strategic services, combined with software, designed to global enterprise marketers. I will let you know once our new positioning is finalized – we would welcome your feedback and advice.

Thank you,

Meg Sinclair

Hi Jeremiah,

Thanks for the post, it is refreshing to read about the SMMS space from a customer’s perspective (as Jay noted above). As is common in emerging industries, positioning for many vendors appears to be confused and lacks a clear value statement. At Syncapse we are undergoing brand positioning research and will be releasing updated materials that highlight our core value offering: expert strategic services, combined with software, designed to global enterprise marketers. I will let you know once our new positioning is finalized – we would welcome your feedback and advice.

Thank you,

Meg Sinclair

I concur with Jay, the best part about this post is how you take the customer position. Â That’s something we can all make sure to do better. Â I think perhaps one of the most valuable points you make is that of simplicity for the customer – in an early and confusing market for buyers clear and direct communication will hopefully be valued in comparison to marketing-speak.

Having participated in the CMS market early on both as a customer and a vendor I’m very interested to see how this market plays out. Â I’m especially interested to see whether vendors looking to be a broad platform covering all use cases succeed or whether specialised vendors who excel at certain use cases win out and which of these buyers will prefer. Â That will certainly impact whether we see more similar or more differentiated messaging.

It’s an early market and there’s plenty of room for innovation

It was a mixture of descriptors, value statements, tag lines, and who knows what. Â A very early market –the community platform space was like this 4 years ago!Â

Thanks Jay, I really appreciate it. Â Seems like there’s a lot of opportunities these vendors could use help in positioning.Â

This is such a timely article for our agency as we are currently writing a POV/recommendation for this space, and it certainly mirrors that same feelings we are having. The next logical follow up would be a feature set comparison – which you mention above – and I’m curious when something like that would be available? Thanks a bunch. Really helpful insight.

My sense is that the confusion is mostly due to the fact that a lot of vendors are rushing at the commondity level. Â They are just replicating the race to the bottom that the campaign management vendors did in the early day of ERP/CRM. Â Differentiation comes from the leading edge not the obvious stuff (e.g., integrating across channels).

Also, a must read by Dachis group’s Peter Kim on the value of strategic RFPs

http://www.beingpeterkim.com/2011/07/rfp.html

He approaches this same topic (the dating process as a whole) but from an agency perspective. Â In general, I agree that lazy buyers that copy and paste RFPs are doing themselves a dis-service as they are likely to get ignored or labeled as “problem clients”.

Good food for thought.

Developing messaging for specific market segments certainly helps customers to understand what is puprose-built for them. Sendster’s social media marketing platform is designed purely for bar and restaurant businesses, which makes it easier for us to articulate the offering. Although, as this is an emerging market, it is still a challenge.

As always, this is a very well thought out and comprehensive post. It’s always useful to see things from a buyer’s perspective. As you said, the nomenclature is still evolving and will probably continue to do so.

I was curious about one thing though. It seems that messaging text about MutualMind in your spreadsheet is from the intro paragraph from our product features page. The main messaging for the product is right on our home page (quoted below).Â

“MutualMind is an enterprise social media management system. We offer powerful listening, social intelligence that drives business actions and integrated engagement to take your social media campaigns to the next level.”

Thanks again and keep up the great work!

Babar

Co-founder, MutualMind

As always, this is a very well thought out and comprehensive post. It’s always useful to see things from a buyer’s perspective. As you said, the nomenclature is still evolving and will probably continue to do so.

I was curious about one thing though. It seems that messaging text about MutualMind in your spreadsheet is from the intro paragraph from our product features page. The main messaging for the product is right on our home page (quoted below).Â

“MutualMind is an enterprise social media management system. We offer powerful listening, social intelligence that drives business actions and integrated engagement to take your social media campaigns to the next level.”

Thanks again and keep up the great work!

Babar

Co-founder, MutualMind

Babar thanks Here’s what I captured, Â ” MutualMind: offers you the most comprehensive suite of features designed to take your social media campaigns to the next level”

Did your site change at all? Â I took the measurement all within the same morning.In any case the messaging you put above in the comment, is slightly different than above, however I’m not sure why it’s different.

I have played with some of these Social Media Platforms, and I must say they all approach Social Media from different angles. Â The dashboard is the most important feature, visual analytics and tracking is next, team management and auto posting feature after that. Â The bottom line is the platform needs to be affordable for small business to purchase and use.

This is great information on Social Media Management System. Thanks for the post.

Earlier this year I spent months on evaluating tools for my company’s social media program. Whilst I knew was I was looking for in terms on functionality, it was close to impossible to make a short list of vendors without having been through a product demo.

With a few exceptions, all vendors promise to be a one-stop-shop for monitoring, publishing and analytics, true? This is far from reality and I’d like to categorize the current vendor landscape into: Monitoring tools, publishing tools and analytical tools. Although there’s an overlap with tools such as Radian6 (who’s core function is monitoring but has an engagement console) and Sptedfast (which has superior publishing options but fairly limited monitoring engine).

As Jay mentioned in tbe first comment to this post, the landscape is moving from left to right in the hype cycle… Question is when they will reach maturity?

JO: Does Altimeter predicts more consolidations in the industry, such as salesforce’s acquisition of Radian6… Or are we more likely to see vendor jpint ventures such as Jitterjam and Meltwater?

(disclusure: i’m not a client of any of the mentioned vendors, but have used them all)

> I expect the List of Positioning Statements may increase keyword value even more  oops.Â

> Additionally it sounds like a knock on the door for Ad Agencies

> One of the few places confusion doesn’t lead to profit… unless your agenda is to bring back Gross Rating Points and re-enter the market as a simplified form of measurementÂ

Great post. Thanks.