Which VC invested the most frequently in Silicon Valley Social Networks? Surprise! They’re from NY! This is part of my continue industry analysis of the changing digital space (see all posts tagged VC), but probing which investors are most active –and are bellwethers for finding future growth companies.

Ever wonder who’s behind the backing of some of the fastest growing technology companies? To find out, I created tables and collected public data to list out the specific investors of each of the major social networks, and social media sites, and conducted frequency analysis of the investors to find out. This is part of my continued coverage of investors in the social business space, read the rest of my posts, analysis, and insights to this important group in our industry. One caveat, I’m not a financial analyst, I’m an industry analyst, and this data shouldn’t be considered for investment purposes.

Financial investment data of these social networking companies seems like it’s easy to get, but it’s very unstructured. The data was all over the web, it was hard to find a single repository of information, common sources were press releases, wikipedia, CrunchBase, and corporate web pages. It’s difficult to tell the specific amount each VC put into a shared investment round, even probing through the S-1 filings would not yield the specifics of each investor.

Variations on Investments Segments VC Strategies

- Early Stage Funding Modest. Research found there were over 120 distinct investors, which includes about 50 individual investors or angels. Among them, most investment rounds in A-X had multiple investors in each round. A handful of angel and seed rounds had individual investors. Seed round amount across the 17 startups was a mere $3m, yet the sum of the angel rounds grew to $863m, a big chunk of that amount is Reid Hoffmans multi million dollar investment into Zynga, which in some categories can be considered to be as large as some C or D rounds.

- Later Stage Funding Balloons. Across this category of 17 social networks, the largest rounds of funding were within C and D, each over 1 billion. A Rounds across these startups were a sum of $85m, followed by B Rounds of $620m, C Rounds of $1,2b, D Rounds $1,7b, then a tapering off as E of $452m F of $376m and G Rounds of $110m. As usual the later rounds had institutional investors, banks, and larger VC firms. The amorphous term “venture round” (a sum of $2.5b) in this space was often a late stage growth round, which, in my opinion, was used to bolster valuation before a startups material event.

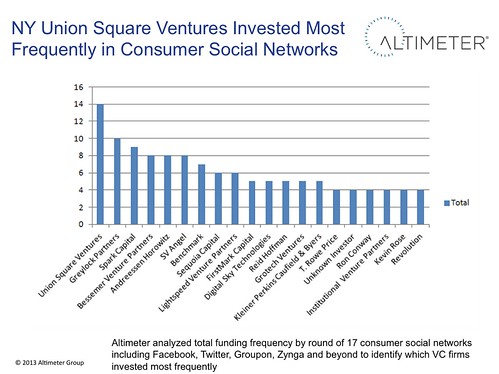

- NY Union Square Ventures Leads the Way, Frequency Wise. While this doesn’t account for total size of investments, we found that NY based Union Square Ventures invested in many deals, and had up to 14 investments in social networks over the past years. Like most rounds, they were involved in multi-investor deals, and frequently was involved in majority of A and B rounds. This investor, placed many investments a early A, then came back for B through C after they saw traction.

Data: Frequency of VC firms who invested in consumer social networks

1. Union Square Ventures invested in 14 distinct investments:

Partial investor in Foursquare, Angel Round ($1.35M)

Partial investor in Foursquare, B Round ($20M)

Partial investor in Foursquare, C Round ($50M)

Partial investor in Twitter, A Round ($5M)

Partial investor in Twitter, B Round ($15M)

Partial investor in Twitter, C Round ($35M)

Partial investor in Zynga, A Round ($10M)

Partial investor in Zynga, A Round ($5.03M)

Partial investor in Zynga, B Round ($25M)

Partial investor in Tumblr, A Round ($750K)

Partial investor in Tumblr, B Round ($4.5M)

Partial investor in Tumblr, C Round ($5M)

Partial investor in Tumblr, D Round ($30M)

Partial investor in Tumblr, Venture Round ($85M)

2. Greylock Partners invested in 10 distinct investments

Partial investor in Facebook, B Round ($27.5M)

Partial investor in Groupon, D Round ($950M)

Partial investor in Gowalla, B Round ($8.29M)

Partial investor in LinkedIn, B Round ($10M)

Partial investor in LinkedIn, D Round ($53M)

Partial investor in Digg, A Round ($2.8M)

Partial investor in Digg, B Round ($8.5M)

Partial investor in Digg, C Round ($28.7M)

Partial investor in Instagram, B Round ($50M)

Partial investor in Tumblr, Venture Round ($85M)

3. Spark Capital invested in 9 distinct investments

Partial investor in Foursquare, C Round ($50M)

Partial investor in Twitter, B Round ($15M)

Partial investor in Twitter, C Round ($35M)

Partial investor in Twitter, D Round ($100M)

Partial investor in Tumblr, A Round ($750K)

Partial investor in Tumblr, B Round ($4.5M)

Partial investor in Tumblr, C Round ($5M)

Partial investor in Tumblr, D Round ($30M)

Partial investor in Tumblr, Venture Round ($85M)

4. Andreessen Horowitz invested in 8 distinct investments

Partial investor in Groupon, D Round ($950M)

Partial investor in Foursquare, B Round ($20M)

Partial investor in Foursquare, C Round ($50M)

Partial investor in Zynga, B Round ($15.2M)

Partial investor in Pinterest, B Round ($27M)

Partial investor in Pinterest, C Round ($100M)

Partial investor in Pinterest, D Round ($200M)

Partial investor in Instagram, Seed Round ($500K)

5. Bessemer Venture Partners invested in 8 distinct investments

Partial investor in LinkedIn, C Round ($12.8M)

Partial investor in LinkedIn, D Round ($53M)

Partial investor in LinkedIn, E Round ($22.7M)

Partial investor in Pinterest, A Round ($10M)

Partial investor in Pinterest, B Round ($27M)

Partial investor in Pinterest, C Round ($100M)

Partial investor in Pinterest, D Round ($200M)

Partial investor in Yelp, B Round ($5M)

6. SV Angel invested in 8 distinct investments

Partial investor in Facebook, B Round ($27.5M)

Partial investor in Foursquare, Angel Round ($1.35M)

Partial investor in Foursquare, B Round ($20M)

Partial investor in Gowalla, B Round ($8.29M)

Partial investor in Twitter, A Round ($5M)

Partial investor in Zynga, A Round ($10M)

Partial investor in Branch, Seed Round ($2M)

Partial investor in Digg, A Round ($2.8M)

Highlight: Digital Sky Technologies

While not a frequent investor, Russian based DST (I’ve had a dinner with Yuri to hear his strategy), when they did invest, it was large sums, and large amounts, their current investments include:

Lead investor of Facebook $200,000,000

Partial investor of Groupon $950,000,000

Partial investor of Twitter Round $400,000,000

Partial Investor of Zynga $15,200,000

Concluding Remarks: At first, it’s surprising that the most frequent investor of silicon valley social networks is NY based Union Square ventures, but if you look at the pattern, they placed early bets, saw growth, then double and triple downed their investments. While frequency doesn’t account for total fund performance, it demonstrates the specific strategy some VC firms are playing. On the other hand, Russian Based DST places few bets, but when does, places them big and strong, after seeing growth. Both investment strategies are needed for emerging markets, both for initial catalyzing, then followed by acceleration, then increased in valuation. These patterns help to define the market maturity of a space, and you should use them to identify maturity stages in the markets in which you’re acting.

What about our competitors such as Slideshare, Scribd and Docstoc? Surely they are worth of mentioning Jeremiah? One factor might be they took lot less funding than the ones you have mentioned

A fair question E,

There are thousands of startups I could have chosen. For this sample set I looked for: 1) Large social networks that had received media attention 2) Public information about funding (the ones you described, may not have info 3) Frequency of funding so I could delve under covers and find patterns.

Also, because these companies are larger, they’re often deemed successful by the investment community, and I wanted to see what patterns arose. I’m aware of the companies you mentioned having financial success, through company growth and Slideshare’s sale to LI.

Thanks. Love to see an analysis on revenue contribution to Linkedin from Slideshare and the potential future for Slideshare as a separate brand.

Just FYI: In 2007, we setup edocr after being inspired by Slideshare, as it was a site for slides – and we were a site for documents. They have done an amazing job. Still think the sale price was low, but hey, end of the day, that might have been the best offer on the table.

In terms of our own predictions, we think Scribd will be bought be Yahoo! for $1 bn. You are probably in a better position to judge than us from across the pond on this..

Nto surprising, but good to see data. It’s why even though Pinbooster is based in DC, I spend sooo much time in New York meeting with investors (and clients). Thanks, Jeremiah.

Thanks Dave. How about in Silicon Valley? Any travels there for investors?

Leading Moving Company in India

| Express shifting in India | Best Moving Company | Call Now: 93825 17189 Packers

and Movers in Delhi : ICM Packers

Movers, the name has the Best Customer Review on Moving:.

Nice data that you have provided. Interesting to know that who are the major investors in social media market.

Really great information shared for the users to know who are the main and lead investors in social media.

Really great information shared for the users to know who are the main and lead investors in social media.

Interesting data you got here. Thanks for sharing this with us!

i am going to build a network marketing company and a social networking site with it. i want investors in this great business. those who are interested to invest in this business and become partners in it. plz contact me @ bassamhashmi@yaoo.com. skype name: bassam.hashmi

Trade Tech and Consult Ltd

is the most trustful

Name in business consultancy in Africa.

We offer you:

Due diligences, business and

investment consultancy, trading and analyses in Ghana and Cameroon

In Ghana, we offer you about 500 acre gold mining concession, mines,

JVA .

We deal in real estates

and trade in wood

(Red beans,

Cashew, Senya, Azfelia Africana and Tali wood) and Ginger too.

We

exclusively offer business

retail, business expansion and promotion services for new products who want to penetrate and explore

the new local market (startup manufacturers who want

to expand or are looking for new markets). We also deal in real Estate.

GREETINGS EVERYONE

I AM MARK I AM FROM NEW YORK AND I WAS THINKING ABOUT BUILDING SOCIAL NET WORKING VERY DIFFERENT THEN FACEBOOK, TWITTER, ETC AND I HAVE VERY GOOD DOMAIN NAME REGISTRATION AND START TO DEVELOPING MY WEBSITE, BUT IM LOOKING FOR INVESTOR, VERY GOOD DOMAIN NAME MY HEART SAID ITS GOING TO BE GREAT WITH THIS DOMAIN NAME AND THIS IS GOOD CHANCE TO INVEST IF YOU GUYS SEE THIS MASSAGE AND LET ME KNOW THX. MY EMAIL markssunwar@gmail.com thx so much