Clients can access the full report The Forrester Waveâ„¢: Community Platforms, Q1 2009 on the Forrester site, however the high level findings are available below, as with all of our reports, we stand by our products.

Communities are a powerful way for businesses to grow

Used correctly, communities can impact the top and bottom line of company’s financials: from brands encouraging customers to self-support each other (reducing costs), to spreading word of mouth to each other (efficient marketing and increased sales) to crowd sourcing innovation (streamlining R&D) communities matter more than ever –especially during a recession.

What you must do before you select a vendor

Many of our clients follow the POST methdology, which is a framework for them to first understand the People they’re trying to reach, and how they use social technologies. Then to pick an Objective that aligns with their business, next, they will spend most of their time scoping out the Strategy, which includes internal processes, stakeholders, roles, budgets, empowerment, policy, and change management. Once you’ve done that, only then you’re ready to choose a vendor, which is the Technology. As a rule of thumb, successful brands focus about 80% of their efforts on the People, Objectives, and Strategy, and about 20% effort on Technologies –don’t get it backwards.

Over 100 vendors in this commodity market

Many an entrepreneur has realized this community opportunity, when I started to cover this market there were 8 vendors on my list, today the space now boasts 100 vendors and it continues to grow. Fortunately, the Forrester Wave reports are designed to segment crowded industries. It’s important that your realize this report is for interactive marketers at enterprise-class companies that are seeking to deploy customer communities not for the internal intranet, collaboration, or insight community vendors.

Therefore brands seek solution partners–not technologists

Having spent my time as a community manager at Hitachi and coupled with research we know that successful community deployments are far more than forums, blogs, rss or other technologies. As a result, we applied over 60% of our weighted criteria based on what our clients tell us they want, a solutions partner that delivers strategy, education, services, community management, analytics and support. During a recession, brands want to be sure that vendors are around for the long term, so we also factored in leadership, executive team, client base, and of course, financial viability.

Key findings of the 9 vendors

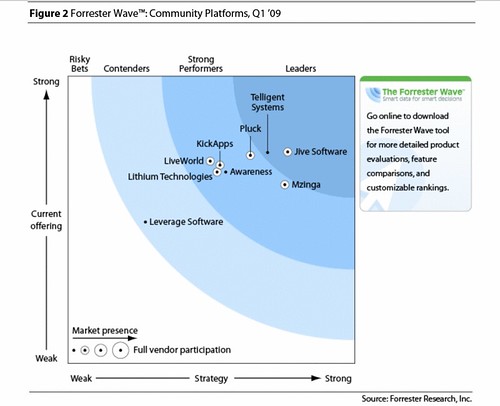

What did we find? First of all, this is still a very young market, with the average tenure of a company being just a few years in community. Despite the immaturity, we evaluated nine and were impressed with Jive Software and Telligent Systems who lead the pack because of their strong administrative and platform features and solution offerings.

Next, a group of vendors ranked as strong performers: KickApps and Pluck enable large Web sites to quickly scale with social features. Also in the strong performer category, Awareness, Lithium Technologies, and Mzinga enable brands to build branded communities while LiveWorld offers brands agency-like services. While Leverage Software is not on par with the others in the category, they are ideal for medium-sized businesses and due to their cost-effective platform could have a strong position during this economic downturn.

Above Graphic: Forrester Waveâ„¢: Community Platforms, Q1 ’09

Customize the Wave report to your business needs

We don’t live in a world of absolutes, and we understand that the needs of one brand will differ from another, so clients that can access the report can also download the excel sheet. This detailed excel sheet for clients (which has scores, explanations, criteria, scoring criteria) has ‘sliders’ and ‘toggles’ that make it easy for brands to dial up or down specific criteria creating a custom Wave report for their needs. Different business needs require different vendor offerings, so the Wave is flexible, you can make it your own.

A summary of the rigorous methodology:

I encourage our clients to be open and transparent about their products and services, in order to build trust with their market, so I’m holding myself to the same rigors, here’s a high level summary of the process:

First, we vetted the 100 vendors to submit to a vendor product catalog, over 50 submitted which we used the data to pair down who were appropriate for the Wave report. Hands-on lab evaluations: I spent up to 6 hours with each vendor in a windowless room to evaluate their product live using common customer scenarios. I grilled the executive team, and discussed their strengths and weaknesses. Product demos. We asked vendors to conduct demonstrations of their products’ functionality. We used findings from these product demos to validate details of each vendor’s product capabilities. Customer reference calls. To validate product and vendor qualifications, Forrester also conducted reference calls with up to three of each vendor’s current customers for a total of up to 27 customer calls. We collected hundreds of screenshots, presentations, samples, reports and all of this information was entered in a multi-tab spreadsheet that accounts for thousands of cells, scoring, and detailed explanations which clients can use to toggle up and down specific needs as in some cases, specific feature needs may need to be highlighted over others. In the bottom links, I’ve made my research process very transparent, and have indicate the other three other blog posts documenting this laborious research effort.

The conversation is just starting

Although this report is a snapshot in time, and some vendors have expressed they’ve made some improvements to date, to keep this long process from going further, we have to put a cap on the updates. Therefore, I will continue to keep the market updated with the the social networking weekly digest just as I have for the past years. In the spirit of the community conversation, if you’re a vendor in this wave in this space, I encourage you to voice your opinion online, I’ll make sure the market sees it, I strive to be fair.

A very sincere public thanks to the team

This was the most difficult project I’ve had to do in a long time, and I’d like to thank Shar VanBoskirk (editor), Christine Spivey Overby (editor and my manager), Angie Polanco (Research Associate), Oliver Young (subject matter expert), Sarah Glass (who went beyond the call of duty as a Senior Research Associate), Zach Reiss-Davis (Research Associate), Megan Chromik (editing), and Josh Bernoff (moral support), I couldn’t have done it without you guys, I assure you, it was painful for them as well as me.

Helping decision makers to be successful

Yet the pain will pay off for our clients as brands can easily find vendors that will meet their specific needs. I’ve been passionate about the community market far before I became an industry analyst covering this space, and am glad to serve the industry. We went to great lengths to be objective, accurate, consistent, detailed, and fair and hope this accelerates your business. Thanks for your patience, and enjoy the Wave!

Related Resources

I’ll be updating this section as I see interesting voices from media, vendors, brands and customers.

Jive and Telligent have made the report available Read Write Web: Report: Community Platforms Market Led by Jive Software and Telligent Leverage Software CEO Mike Walsh (and other vendors) have responded in the comments Josh Bernoff: Picking a community vendor? We’ve evaluated a bunch Tom Humbarger: Questions if these vendors are eating their own dog food read Walking the “Social Media Walk” Telligent’s corporate blog chimes in and makes the report available for you. Connie Benson: Wave report showcases community platforms Neighborhood America CEO, Kim Patrick Kobza: Forrester Wave Report Part 1 Forrester’s Interactive Marketing Blog: I’ve cross posted this same content on our blog for interactive marketers. My follow up post: How we filtered 9 vendors out of 100 for the Community Platform Wave Webinar: I’ll be conducting a teleconference on Feb 3rd, hope you can attend Max Kalehoff discusses the wave and talks why he choose Telligent –and how they can improve. Destination CRM: Forrester Waves to the Top Providers of Community Platforms Barry Hurd: Corporate Social Media Platforms – great info to check out. Mediapost: Ultimate Guide To Community Platform Technologies

Read more about this Wave Research project:

Part 1: Starting the Wave

Part 2: Data Collection Process

Part 3: The Analysis Process

Part 4: Announcing the Wave, the final report

Great new info. I’m writing a quick FYI on my own blog and sending people on over. A lot of my readers are looking for corporate solutions and I’m sure they’ll find it very informative.

Thanks for providing such quality info in your writing Jeremiah.

~Barry

Jeremiah,

As always, you have done an excellent job on this report! It must have been incredibly difficult to select 9 vendors from the 100 out there, and then dig into the details to create and support this report.

There are a few things that I would like to point out to your audience that aren™t necessarily apparent that have an impact on the scoring and may be important for your audience. I also want to convey what we have accomplished since meeting with you “ much of what was the direct result of your input during the process “ thank you for your most valuable feedback!

The one area that I found interesting is the formula that drives the placement of a Company on the Wave. For example, when defining how a company serves the market, your formula looks at the ratio of clients in a target market as compared with the total customer base, but does not consider the raw number of clients served in a particular market.

For example, we have 70 or more clients in the Enterprise market that you are serving in addition to other markets that we serve (SMB). Think of us like salesforce.com in this way. They can serve a company of 10 as well as Cisco who has 10,000 or more sf.com licenses. Because we offer our solution as a true multi-tenant SaaS model, like sf.com, we can cost effectively deliver to Fortune 100 client (18 are among our customers), and companies of 50 employees who want to improve the relationship with their customers or improve communication among their own employee base.

The point that I want to convey to your audience is that we were actually penalized for serving multiple markets. If we had only 50 clients, who may be the case with others who scored higher on the report, but those 50 clients made up 100% of our customer base then we would have received a much higher score in that area. This is a point that may be important for you audience to know “ they may want to dig into this as they evaluate the report and a vendor.

I also want to let you know that I am thrilled to have added to our leadership team having hired a VP of Sales (former VP of Sales at Jive Software) and VP of Client Services (Adobe) to better serve our clients. Each of them are quickly adding to their teams to meet the broader needs of Enterprise clients. Based on your feedback, we are now fully staffed to deliver strategic and tactical services to provide a full solution to our customer base. As you have learned during your evaluation process, we have also recognized the need to provide full services from team evaluation, needs assessment, resource analysis, community strategy and resource planning, roll-out strategy, moderation, reporting, community marketing and ROI and TCO analysis. We have added these resources and are continuing to add to that team.

We have also added many of the featured that you highlighted as missing during our meetings. Version 6.4 includes additional analytics, reporting, additional APIs and continues to add to our people-centric solution networking with the introduction of GeoSocial, which has been incredibly well received “ particularly by our Fortune 100 clients.

We are pleased to have begun working with Fortune 25 retailers, Fortune 50 banks, and Fortune 100 media and tech companies since the completion of the report, on both external and internal employee communities. We are thrilled to have McKesson, HP, Microsoft, Omnicom, Milken Institute, Wells Fargo, American Bar Association, Joie de Vivre, FrontRange, Callidus, Toy Association, Stanford University, Big Brothers Big Sisters and Ingram Micro; among our diverse client base. With every client “ big or small, we are working together with incredibly smart people to address important opportunities and problems.

We deeply value the work we do with so many incredible customers of all sizes. Our clients of 100 employees and 100 customers are just as important to us as those with 300,000 employees and millions of customers. We love them all and we strive to serve them well. We are positioned to and will work harder than ever to serve our clients.

We look forward to your continued feedback and analysis so we can continue to drive vision and provide valuable solutions to our key market segments and better serve our clients “ which is the most important thing we do.

Thanks for your great work, Jeremiah!

Mike

ceo

Leverage Software

@mwalsh

Does it really make sense to directly compare software publishers and SaaS providers together? If I understand the businesses properly, LiveWorld, Lithium, Telligent and Mzinga are SaaS companies, but Jive and Kickapps are software providers with consulting services available. A bit of apples and oranges isn’t it?

(Former LiveWorld employee.)

Mike,

Thanks for this thoughtful comment. I’ve indicated on the blog post you’ve responded here.

Nick

Good question, it really doesn’t matter as much Nick, and here’s why: Jive offers both SaaS and on-premise and although Telligent offers on-premise they have hosting partners. All the other players are SaaS only.

I did indicate in the weighting if they offered both they would receive a higher score.

What’s really important is the features, services, and solution that they bring forth.

Jeremiah — Congrats on the report. We’re very honored to be included. I’m planning to follow up with a few more comments but have to run to a meeting. Meanwhile, I did want to clarify a point that Nick Arnett raised in the 3rd comment–KickApps is a SaaS company. We provide a hosted service and also APIs.

– Michael

SVP, Marketing

KickApps

Jeremiah, thank you for what I believe to be a fair assessment of Telligent in this Forrester Wave report. We are continuing to make significant investments in R&D, Professional Services, and our partner ecosystem to ensure that we remain one of the leaders in this space.

Lawrence Liu

Director of Platform Strategy

Telligent

Jeremiah,

Great job and a very thorough analysis.

Does your opinion or analysis change given the recent layoffs at Mzinga this week and at Jive in October?

My point is that I want my social media vendor to be active and visible in the social media space – which means that I want them to be blogging, twittering, and participating in other social media activities.

I thought Mzinga used to do the best job of any of the leading vendors with their participation in social media. Their management profiles set the standard for how people need to be socially available in today’s Web 2.0 world and they proved it by including office and mobile phone numbers along with links to Twitter, Facebook, blogs and LinkedIn in their profiles.

Mzinga used to some very active social media people listed as Thought Leaders on their website. People like Aaron Strout (@aaronstrout), Jim Storer (@jstorerj), Rachel Happe (@rhappe) and others are no longer with Mzinga. They currently list 4 Thought Leaders and I’ll let you draw your own conclusions.

Looking at the other leading vendors, they do not appear to be very active either. Telligent’s CEO Rob Howard has a blog, but his Twitter traffic is pretty minor. The positive is that Telligent does have a number of blogs linked to their website, which I do view as a positive. Jive has a blog on their website and their CEO David Hersch has written some posts, but it hasn’t been updated since November.

So my question is, can a social media company really be a leader when they don’t have any social media leaders or when their social media efforts come across as fairly weak?

Don’t social media companies have to walk the ‘social media walk’?

I’d appreciate your thoughts…

Tom Humbarger

[full disclosure – I was a Mzinga customer for over 2 years and am now working with them on a new community]

Tom

Thanks for the questions, I’ll answer what I can here.

I’m very aware with the layoffs, and even met with Jive’s VCs after the RIF. We had a fact checking session in Nov, and some employee numbers in multiple companies were changed. Keep in mind, in some cases, layoffs can actually decrease costs, and make the company more attractive to clients and investors. As hard as it is to swallow, layoffs can sometimes be good for a company, although painful for people.

I love your questions about walking the talk. This report did not measure their marketing ability, that would be an entirely different report, this one was needed to help my clients make a decision on who to choose.

However, one of the criteria I did rate was whether or not the community platform vendors offered a community for their OWN customers.

Speaking of eating dog food, in most cases four of the vendors had a community for either business or technical folks, and three of them had a community for both roles.

Sadly and ironically, in two cases, they didn’t have a community at the time I took the measurement.

So, to address you question, I certainly did weight, and score them on using their own software with clients.

At Lithium, we™re proud to be included in this report as one of the 9 leaders out of 100 in the space as well. We think this report represents a really important milestone for our category “ the fact that Forrester has honed in on Community Platforms and published this first ever report means that the space is rapidly evolving and changing and that, most importantly, the real business value to customers is becoming more evident. We wanted to thank Jeremiah and team for all the work that has gone into starting this process.

Regarding the SaaS discussion, I think I™d tend to agree and disagree. I would agree with Jeremiah that what is really important is the solution and services that you are able to provide customers “ in some sense, regardless of deployment model. Customers should choose partners based on value they provide. Success for the partner then comes from the ability to provide the richest solution and services that drive the most vibrant and engaged community.

However, I would disagree with the notion that there is no difference between SaaS, hosted, and on-premise. Specifically, these models provide different levels of value and success to customers. The SaaS model allows us as partners to drive data and insight “ not only about a specific customer™s community, but across many communities “ back to customers so that we can make in-flight adjustments to ensure a community thrives. On-premise or hosted models cannot offer this level of value. The other thing that the SaaS model does is dramatically drive down the total cost of ownership for customers “ this means greater business ROI “ which in these times is critical. We’d love to see the next version of the Wave recongize these advantages.

There are lots of things we found noteworthy in the report, and I™m sure we™ll discover and share more in the days and weeks to come. In our perfect world, we™d like to see market presence play a larger role in the Wave “ our experience is that customers are quite sophisticated in their choices and that the market often has a wisdom of its own. We at Lithium were delighted the receive the highest score in the Clients category, and in the Service category as well.

We look forward to ongoing work with the Forrester team and our peers in the space to build out this great category!

Sanjay Dholakia

Chief Marketing Officer

Lithium Technologies

OK, I™m back. Again, great work on the report. I know how much work went into this and I was very impressed at how thorough you and Sarah were throughout. I think it™s going to fulfill a big need in the market.

KickApps is extremely honored to be included in the report and are very proud to be recognized in this manner.

One point that stands out from our perspective is your analysis of a full solution services vs a technology approach based on product innovation. I agree with your conclusion that a full solution services approach reflects where the market is today”relatively immature but evolving rapidly. Vendors that are able to deliver technology and business solutions meet the prevailing need today. To that end, we™ve been very aggressive in developing our offerings on that front (led by Tom Gaffney, VP of Customer Success) and have seen immediate returns.

We believe that in the long run this focus will shift to a technology-based approach that is scalable, flexible, easy-to-use, low-cost and consistently innovative (this is the social web after all). This will replace the high-priced, one-off/custom, classic enterprise ˜type™ approaches that take ages to build, deploy and manage and are ultimately very inflexible.

We™ve architected our product offering along those lines”low touch, self service that require a fraction of the cost and time to implement and manage (an extremely challenging undertaking). In our view this will be the winning model and is certainly not mutually exclusive to upfront business/strategy consulting that many customers require. However, this is admittedly a more difficult mountain to climb than building out a large service offering that struggles with low margins.

Thanks again. I look forward to the conversation that comes out of this report.

Michael Chin

SVP, Marketing

KickApps

Jeremiah:

Thanks to you and Forrester on behalf of LiveWorld first for including us in very select company in the Wave report. We’re pleased to be included in the “Strong Performers” category as well.

We recognize, too, that your report must necessarily represent a snapshot at a certain point in time (or it would never be published!). Like Mike Walsh at Leverage, we’re working hard to improve on areas where we need to and that you helped us to identify during the Wave lab evaluation. I have no doubt that this process has made the teams for all of the 9 vendors do plenty of serious self-analysis!

Tom Humbarger also makes a good point about the need for companies to “walk the ‘social media walk.'” I know that’s what I’m trying to do for LiveWorld — not so much to talk about us, but to (stealing a line from Mitch Joel at Twist Image) serve as a “champion of my industry” by blogging, Twittering, podcasting and generally sharing challenges, trends, and best practices that we’re seeing and learning as we go.

Bryan Person | @BryanPerson

LiveWorld social media evangelist

Blog: LiveWorld.com/Bryan

Hi everyone! Thrilling thread! I am returning from my twin’s doctor’s appointment.. Crafting a comment inefficiently on my iPhone… Stay tuned…

Patrick

CMO, Mzinga

(yes, my email signature DOES have all my social links in it! 🙂

Jeremiah, another awesome job. Loved the perspective and your assessment was so helpful.

Great job!

On page 4 of the report (on the version downloaded from Telligent), Jive’s product is listed as ‘SiteLife’ on the second line of Figure 1. This should read ‘Clearspace’. I would imagine that the version number and release date are invalid as well.

Jeremiah,

Let me echo my friends’ sentiments in the comments in congratulating you and Sarah on a job well done. I know first hand that this was a long and arduous process but in the end, I think you guys got it right.

While the company I work for, Powered, is not on this list because we are a social marketing company, I did have the pleasure of participating in the process during my time at Mzinga. It was an informative experience and one that gave me valuable insight into what your customers i.e. marketers are looking for.

Congratulations to all the companies mentioned on this list for a job well done!

Best,

Aaron Strout – CMO of Powered

@AaronStrout

While I really enjoyed the report, I’m fascinated by the comments from the companies covered in it. I wonder why those companies that didn’t make the top tier haven’t chimed in yet..?

While a full service technology vendor might be somewhat desirable, we find that one of the top reasons that our clients (and prospects) want to work with us at Impact Interactions is that we are vendor neutral. We don’t sell software, but instead recommend a platform which truly meets the needs of their project. While I see many of the firms beefing up their professional services organizations, I wonder how successful they will be as any consulting leads only to their product. I think there will always be a demand for those of us who are technology agnostic to help lead organizations through the technology selection process AFTER independent consulting that doesn’t require a particular vendor solution.

Just my two cents. We’ve worked with several of the top vendors listed (Jive, Lithium, Leverage, Mzinga when it was Prospero) and depending upon the specifics of your project’s needs would recommend them.

Our industry has come so far from the days when you used eShare for chat and webcrossing for forums… iChat if you were a non-profit. Congratulations to each of the vendors mentioned and best wishes for 2009 and beyond!

Mike Rowland

President

Impact Interactions

Jeremiah,

Mzinga is also proud to be included as a leader among the top 9 out of 100 companies, and we™d like to thank you and your team for your thoughtful research on this project.. There is a lot of noise in this space (social software? community platform? social media? social applications?) I bet your clients are glad to have you!

To echo the comments made by my peers, we at Mzinga also recognize that there are always areas within our company and our solutions that could use improvement. Mzinga devotes a lot of time and effort to improving and enhancing our offerings, so we appreciate your perspective. Your process helped us clarify our exciting 2009/10 roadmap, which we look forward to sharing with you.

We™re honored to be recognized for our leadership position, but we all know that companies don™t stay there long if they™re not secure, viable, and stable. As you pointed out in your response to Tom Humbarger, sometimes we need to make tough choices (which can be very difficult on a personal level) in support of the broadest interests of our collective employees, customers and future growth/market share. Our company made one of those difficult decision this past week, when we reduced our workforce by about 6% — see article here: http://tinyurl.com/96wupa — we are now EVEN MORE stable and ready to deliver for our customers.

What else… Oh, Tom’s comments: I think that if you look closely at Mzinga™s team, you™ll find no shortage of expertise in all areas of social media strategy, development and management (Heck, we have people on staff that wrote the original forum applications from the ’80s!)… as well as many people who take the opportunity to walk the walk “ and I™m happy to count myself among them — I still learn new things every day, but isn’t that the point?

Okay, back to driving Mzinga towards the darker blue circle!

Cheers,

Patrick Moran

Chief Marketing Officer, Mzinga

Mzinga

Friend me: http://www.new.facebook.com/profile.php?id=599327694

Follow me: @patrickmoran

Nice job Jeremiah. I’m a Jive customer and would agree with your analysis. Its a solid solution and, for us, and has delivered a 7x direct return on investment within 1 year (and indirect return that is even higher).

Interesting that Socialtext is not on the list. Socialtext has come a long way with the 3.0 release.

Regards,

Jason

Yoshi

Good eyes, Telligent is showing an older version, and I’ve sent them the current and correct version (that’s on the Forrester site) for them to replace.

Thanks!

Jason

SocialText just announced their intent to develop public facing communities after I had selected vendors (Cisco too) so that’s why they were not included.

If/when we update the Wave (no plans in the near future) we’ll consider them both for the running, and all other applicants.

I’m going to ping you regarding your ROI, this could be helpful for an upcoming report.

The Wave is hardly forward looking, complete or objective, and is clearly not representative of quality, complete and unbiased research that should guide an emerging industry.

Lost in the hype of the Wave report, was the informed omission of Neighborhood America, 2008™s SIIA Codie award winner for best social network solution. Also the AO 250 finalist and MMA winner, Neighborhood America has some of the strongest credentials and experience in the market place “ a Fortune 500 customer list, multiple lines of business, year over year sales growth, consistent head count, and a world class leadership.

Frankly, Neighborhood America has many accomplishments in fact that many of the other companies on the Wave have not even accomplished in theory – including building communities for the World Trade Center (Imagine New York), Statue of Liberty, Flight 93, much of major media, major brands etc., We are generally respectful and cheer for the success of our competitors and take absolutely nothing away from their many accomplishments. But failure of acknowledgement here is a grossly unfair to the many employees at Neighborhood America and their pioneering and leadership in the social media industry.

So in spite of peer based industry recognition, proven market and financial performance, technical sophistication, and leadership, you have consciously failed to review us, even so much as grant an interview, and left NA off of the list. It is a real disservice to the industry, and honestly a disappointment.

Very unfortunate. The trust that so much of the industry has placed in this type of research is sorely misplaced. It represents a very strong bias and lacks the type of vision that should be expected by its audience.

@MikeRowland We at Telligent would be happy to work with you as a partner! 🙂 We certainly understand the reality that in order for our platform footprint to grow in various industries, geographies, and market segments, it’s much more effective to work with key partners than to try to do it all. You know how to contact me; please don’t hesitate to do so.

@TomHumbarger, re: layoffs by other vendors, I’d say that if nothing else, they show a lack of sound strategic business management. At Telligent, we pride ourselves on being fiscally conservative (from the get-go rather than just the past few months) and focus our investments much more on R&D and customer service/support than on marketing. That’s why we haven’t sponsored every conference or done a new webinar every other week during the past year as some vendors have. It’s also why we haven’t overengineered our products with frivolous features that demo well but don’t get used. And it’s why we’re still hiring great people to join our team. Anyway, my point is that we’ve been very strategic about our business planning for the past few years, and our customers and prospects definitely do take that into serious consideration when comparing us against other vendors.

Lawrence Liu

Director of Platform Strategy

Telligent

Jeremiah,

A lot of good insights here, both in the post itself and in the collection of comments that are accumulating so rapidly.

Awareness is thrilled to be included in the top 9 in such a competitive market. We take pride in the strengths that you identified in your report, Jeremiah, and we are looking forward to some very exciting future developments at Awareness.

We can all agree that it’s great to see leading companies like Sony, who just announced their Awareness-powered community at CES, (http://tinyurl.com/8l27ll) and many others embracing what we all know: that social media is a powerful and transformative force that is more important for companies to leverage now than ever before.

In the extensive discussions and experience we’ve had with our customers and from doing this for a while, we’re lining up a few announcements that we think will help the marketers deliver social media with a clearer focus on business goals and objectives.

Again, great report and thanks for giving so much of your time to this.

John Bruce, CEO

Awareness

john.bruce(at)awarenessnetworks.com

More dialog on this topic has been ongoing at RWW: http://www.readwriteweb.com/archives/community_platforms_market.php Specifically, I wish to call attention to my mention of open source projects and vendors such as Drupal and DotNetNuke.

too bad that Blogtronix was not part of the first wave report here. I know that we missed some due dates when you were putting this together. At least now we can show you a much better new Blogtronix platform (the OzoneOS) next week and the new clients.

Cheers,

Vassil

Jeremiah – this is great work. Thank you! What’s especially interesting to me is that vendors have never had such a public forum to respond before. It’s fascinating to read how they choose to react.

Corey

Agreed, how vendors react to good and bad news is an important indicator of what type of customer experience you may receive–culture lives out on the web as a representation of what lies within.

Jeremiah — How have you factored in vertical/market strengths? Different markets that vendors have chosen to address also dictate their various strengths. Have you looked at these differences? For example, a message board centric solution for customer support is very different from a media-centric, brand driven site.

Thanks,

– Michael, KickApps

Michael

Good question, yes, this is addressed in the report(s).

I spelled this out in the ˜make it your own™ section above. Buyers that are considering a vendor should use the wave excel template to give prioritization to different features such as talking vs listening features.

Regarding focusing on different industries, the top three industries that each vendor represents is listed in the excel sheet, buyers should first look at that. For a larger perspective of other vendors that are not in the wave report, use the vendor product catalog (free with registration) to see a large list of vendors and their primary industry focus.

The Wave report takes into account many types of information related to vendors and the excel sheet gives opportunities for brands to customize their needs, and the Wave report will suggest the right vendors for them to start with.

Hope this helps.

Jeremiah, public congrats to you and Forrester on completing what has been a landmark report – Pluck was honored to be among the handful of firms selected to participate. Wanted to weigh in with a few points interested folks should consider about the Q1 2009 Community Platforms Wave Report to get the most value out of the findings.

1. Things change

The Wave Report process started for vendors back in July of 2008. Obviously, business conditions have changed since then for everyone reading this. For example, we know that certain vendors in the report have significantly reduced the size of their organizations since the data gathering phase and that some have taken their products in new or different directions. In Pluck™s case, we™ve actually expanded our team (by more than 10%), have delivered the industry™s first Facebook Connect integration offering and have developed a range of new reporting and analytics capabilities. We™ve also launched our online customer community called Pluck Connect, which is the online companion to our one-of-a-kind Pluck Socialize customer conference which is held annually in the fall.

2. Not all use cases are alike

The Wave Report calculation model is designed to allow users to adjust criteria weightings to suit the specific requirements of their companies and projects. A vendor who might be a fantastic choice for a small, customer insight community might be inappropriate for an acquisitions-focused campaign site. As the report notes, “Brands with large content Web sites, such as media companies, should look at Pluck as a vendor to quickly add social features to existing content.” This happens to be a particularly strong area for Pluck “ and several of the other vendors have their own scenarios where they are particularly relevant.

3. Consider the whole company

While the Wave Report covers products, community platform buyers do business with companies that in some cases offer multiple products and services. In Pluck™s case, not only do we offer a social media platform, but we also offer an unparalleled collection of high quality content and provide a range of social syndication capabilities that our customers consider critical ingredients for their long-term social media strategies. It™s also worth noting that our parent company, Demand Media is funded for the long-haul with more than $350MM of investment capital and is already profitable “ an important area of attention for buyers who are moving past the experimentation stage and putting long-term social media strategies in place.

I hope my comments above help to more broadly frame the results. At Pluck, we were pleased to see the Wave Report surface as very public validation of the category, are proud to see the coverage of this important topic reflected in the recognition of the role we™ve played in shaping the social media landscape, and the vital nature of these solutions for marketers, media companies and retailers.

Thanks,

Adam

Pluck

http://www.pluck.com

twitter.com/aweinroth

Adam

Thanks, I’d like to respond to some of the excellent points you brought up.

1) The report is a snapshot in time, and this one certainly spans a few months of work. The good news is this blog, the weekly digests, will help to keep the market updated as a supplement. Clients need both kinds of data to be successful, thanks for staying engaged.

2) We agree, brands/buyers should segment business needs using the flexible wave excel sheet.

3) This report was focused on the pure vendor, not the parent company. If I had Sharepoint in this study, I would have evaluated them rather than other Microsoft products. I kept that methodology consistent as I graded Pluck.

You do bring up a good point, as I’ve been impressed with Demand Media’s overall offering, and have blogged it here: http://snipurl.com/9v4fa

I read the summary report earlier this morning … very interesting, but i find the comments even more interesting. I especially like the one from Neighborhood America’s Kim Patrick Kobza. Having been in his shoes for a number of software companies (but now a sales & marketing consultant, I feel his pain of being left out of the mix in the report. In may days, my frustration was then with Gartner’s “Magic Quatrant” (there was no Forrester Wave in the 90’s). But I understand the frustration.

However, using a BLOG comment post to voice one’s decent and take issue with Forrester’s finding is not recommended. Contrary to Kim’s comments, it does come across as sour grapes. There are a number of very strong accusations being made against Jeremiah and Forrester. I have had no dealings with Jeremiah to date, but have with Forrester for over 14 years and find the accusations questionable.

I would hope that Jeremiah provides a response to set the record straight on why NA was not covered or “consciously failed to review” them. In my experience, the failure to be covered usually falls with the software vendor and not the research firm. Also, whether you are Forrester client or not usually does not have a bearing on who ends up in these reports, though investing time in briefing the analysts and spending time with them and allowing them access to clients is very important.

If Kim and NA took all the right steps to be reviewed for this report and still were omitted, then the company has a legitimate beef. Otherwise, this approach to object will not help and only make the situation worse.

Henry

Thanks, you set me up for this blog post that I just published this morning.

In this post I answer how we filtered the 100 vendors down to 9.

http://www.web-strategist.com/blog/2009/01/13/how-we-filtered-9-vendors-out-of-100-for-the-community-platform-wave/

I assure you, I did not consciously choose not to review anyone, I used a consistent methodology that has been done time and time before me with previous Wave reports. My management backs me in this process start to finish.

Jeremiah,

In comment #2, I complimented you for doing a great job and pointed out a couple of items that may not be obvious to the audience at first glance.

I wanted to take a moment to compliment all of the vendors within this report for competing in an ethical and professional way. I also acknowledge to those companies that are not on this report that we, at Leverage Software, have lots of respect for you and consider some of you among the leaders in specific verticals or solving specific problems or addressing specific opportunities.

As Jeremiah’s audience evaluates solutions and providers, I echo many of the previous comments that address the benefits of true multi-tenant SaaS solution (data analysis and comparison that enables community performance improvement), the importance of one™s vertical, whether they are consumer versus B2B, the resources that a company may have or lack, the readiness of the organization, the personality of the organization, etc.

My commitment to those evaluating – we will make it easier for you to evaluate Leverage Software in the upcoming months. We will let you know what we are good at and what we are not, as we respect your time. We will provide you with evaluation and ROI/TCO tools to help you present different options internally. We realize that your job is difficult, and we want to make it easier for you and more efficient.

To our competition, we commit to earning a client’s business on our merits and capabilities, and never by negative comparison. I think this is obvious, but worthy of comment nonetheless. I think highly of our clients, prospects, analysts and our competition for embarking in this new field.

Our primary job is to ensure successful communities “ it™s what we love and what drives us. Sometimes that means that we recommend a competitive solution for a better fit – I’m happy to do that to grow the market and maximize success rate. We want to see all communities thrive, regardless of the vendor “ that™s our thing.

Thanks for sharing!

Best,

Mike

@mwalsh

Mike

Thanks for this, I found that many of the vendors kept the focus on demonstrating their own capabilities rather than trashing the competition.

Overall, this is a pretty friendly industry –but what would one expect from those who are involved with community?

Thanks again.

Great post

good to see the comm platform solution we have employed for our MROC – market research online community is in the top two! 🙂

Cheers

Jeremiah,

This is a great report. But what would you recommend for the small business category? Or even a startup with limited funding?

Most of these seem enterprise level and to get solid features pricing seems high – though I may have missed something.

So could you or any of the readers that know – respond with what would be a good way to integrate a forum, events, member profiles, interaction, directories, etc with options to enter at entry cost?

Would love to know what you all recommend? And if any experience with this category.

Thanks,

Mike

Mike

Thanks, it’s true this is a report aimed at enterprise class clients. I’ve not done enough research to make any public recommendations on SMB class vendors. You should leave your email here on this post, as I think you’ll get contacted.

good post

This is a very interesting analysis and the subsequent dialogue really adds to the overall value. Thanks to all contributors! It was asked above but I’ll ask it again, commerce/community platforms like Joomla and Drupal seem conspicuously absent from this discussion.

I realize that your focus has been solution partners with a full bag of tricks and so perhaps by default an open source system doesn’t seem to qualify. However it would also seem to me that by virtue of the fact that such large development communities have sprung up around these open source platforms, that an equally effective “mashup” of resources could be developed offering an equally robust and effective solution that is also financially attractive to an organization. As companies struggle with the make or buy decision I suspect that they wouldn’t be doing their due diligence if they didn’t seriously consider open source. At least this seems like a worthy footnote for this discussion.

In addition the modular nature of these open source solutions suggests to me that the unique marketing requirements of an organization might be better serviced by open source because of their rich feature list and the ability to tap into lower cost customization. I’d love to hear feedback in this context.

Tom, thanks, here’s how I choose the different platforms

Please note that I interviewed Acquia, an opensource services company, but they weren’t large enough (yet) to support a big brand.

You have to remember, that many brands don’t have a web team that cam implement the technical aspects, and want to outsource development, hence the focus on ‘solution vendors’

More details here, on how I filtered down 100 vendors to 9

http://www.web-strategist.com/blog/2009/01/13/how-we-filtered-9-vendors-out-of-100-for-the-community-platform-wave/

I was told the VP of Sales at Leverage (former Jive guy) quit the company after a short tenure. It seems they are having a tough time keeping executives.

Great work Jeremiah. I too would love to hear more about small business class or start-up solutions. I know there are many platforms out there, but I’d like to see a similar analysis on them from you because some of them are junk, and it’s hard to determine which can really deliver for us small guys.

Hey JO you left off Ecademy why? It’s one of the few real global communities.

Um… community needs to speak the same language?

One-size fits-all apps do NOT create community!

I’m sorry, but I refuse to read so much text if there is no recognition whatsoever that software applications don’t matter.

One proof of this fact is twitter.com: This service has no sophistication whatsoever. The main reason why it is successful is because it utilizes the Wisdom of the Language (and also that communications technology today are able to transfer data at much higher rates than 10 years ago).

😐 nmw

I am still not certain on the selection criteria for the technologies. The report is very useful though

Hi,

I’d like to point to the FLUX platform. http://www.flux.com/.

The platform power now big part of Viacom/MTVNetworks brands sites, but not only.

seems like this discussions is a little high level and could be brought down for those looking to enter in the market

Hi Jeremiah.

In your report, what do you mean by “market presence” and “full vendor participation”? I notice that Telligent is very low in this/these criteria.

sports shoes

Nike Sport Shoes

Women's Nike Sport Shoes

Men's Nike Sport Shoes

You're right! Successful community deployments are far more than forums, blogs, rss or other technologies.

I understood the high level summary of the process because of that simple graphic inserted into the post. And now, I start the Wave (Part 1).

kickapps committed fraud and theft of intellectual property – they looked for a reason to cancel all of their advertiser based accounts, despite having a contractual obligation to support them when they changed their business model to new accounts only being paid. They fraudulently concocted reasons to cancel as many advertising based accounts as they could, destroying the work of people who had spent years creating communities.

This action was totally and utterly dishonest, consister of fraud, theft, breach of contract, etc.

Thats like an earth’s crust

Thats like an earth’s crust

Thats like an earth’s crust

Thats like an earth’s crust

Thats like an earth’s crust

I still find all these articles hard to understand, but I do understand one thing: a company’s success depends on their marketer’s business strategy and ability to find good sources of income. That is what makes a good company after all.

Dee

I still find all these articles hard to understand, but I do understand one thing: a company’s success depends on their marketer’s business strategy and ability to find good sources of income. That is what makes a good company after all.

Dee